Vacant Aveo Group retirement villages sold to Queensland Government by CBRE Healthcare & Social Infrastructure team

Contact

Vacant Aveo Group retirement villages sold to Queensland Government by CBRE Healthcare & Social Infrastructure team

The Queensland Government Department of Housing and Human Services recently purchased two retirement villages in Windsor and Toowoomba, from vendors Aveo Group, to meet social housing demands in deals transacted by CBRE’s Healthcare & Social Infrastructure team of Marcello Caspani-Muto, Will Carman, Sandro Peluso and Jimmy Tat.

An increasing number of vacant aged care facilities are being repurposed amid a growing need for social housing.

The Queensland Government Department of Housing and Human Services recently purchased two retirement villages in Windsor and Toowoomba, from vendors Aveo Group, to meet social housing demands in deals transacted by CBRE’s Healthcare & Social Infrastructure team of Marcello Caspani-Muto, Will Carman, Sandro Peluso and Jimmy Tat,

The 30-unit Windsor property at 51 Norman Parade will provide secure and affordable housing for older adults and once rebuilt, the Toowoomba property at 279 Bridge Street will house 50 residents.

Both vacant properties sold for circa $10 million.

“The popularity of vacant retirement and aged care assets is comfortably at record levels. Broader challenges with rising construction costs across the commercial and residential markets, have acted as a catalyst for demand in this sector,” Mr Caspani-Muto said.

“With development risk and construction costs at all-time highs securing large landholdings with significant existing improvements is highly compelling. We are seeing a steady increase in the number of tenants and owner occupiers entering the space through creative conversions to aged care, healthcare, NDIS and accommodation uses.”

The Queensland social housing plans are part of the $3.9 billion investment in social and affordable housing by the Queensland Government.

Data from the Queensland Council of Social Services showed that in 2021 residents had an average wait of nearly two years for accommodation in Toowoomba, an increase from just eight months in 2017.

“Our holistic approach means we are not just providing housing assistance, but also connecting people to support from a range of government and non-government agencies that are specific to their individual needs,” Housing Minister Leeanne Enoch said.

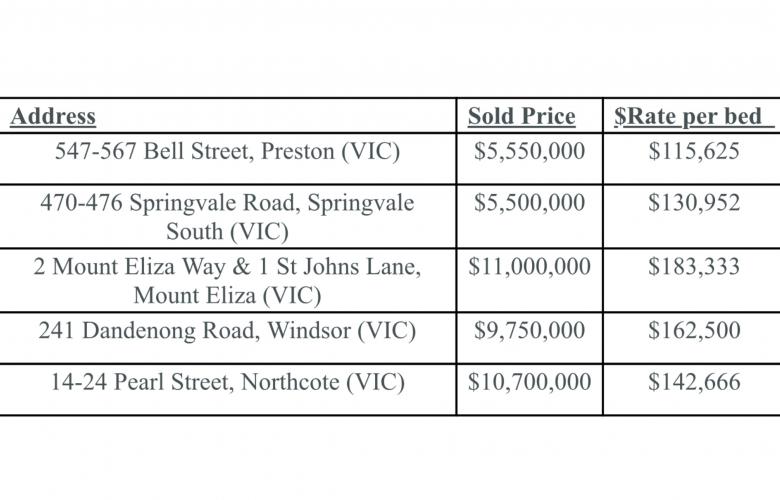

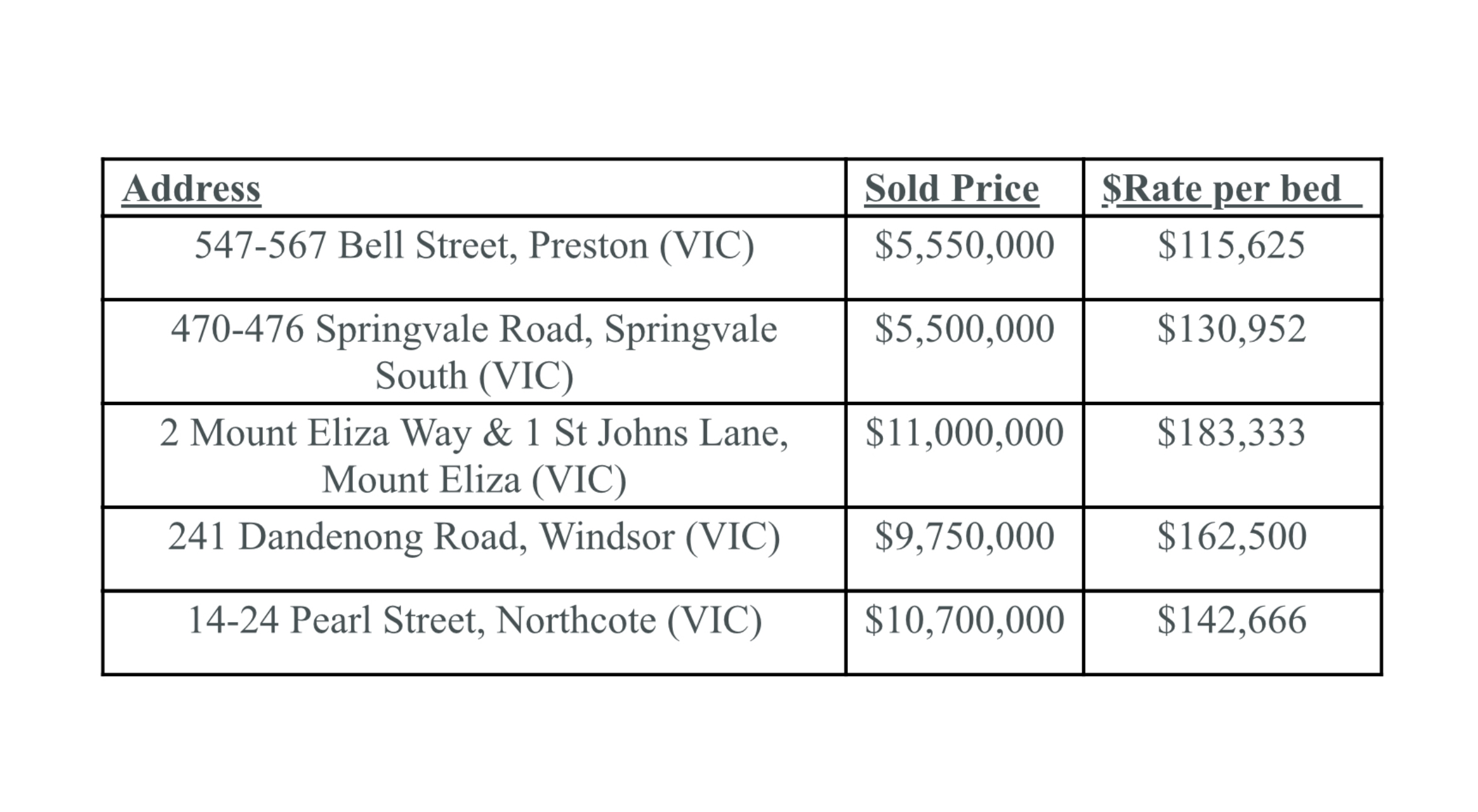

In addition to the Queensland transactions, CBRE has been involved in a further five vacant aged care sales:

Strong Investor and Occupier Demand Drives Growth of Life Sciences Asia Pacific Hubs - CBRE

Click here to read article on Retalk Asia: Life sciences real estate reaches 100 million sq. ft. with major hubs like Shanghai, Beijing, Tokyo, Singapore, and Melbourne; US$18 billion of funds has been raised to invest in life sciences real estate.

Sign up here to receive COMMO newsletters and breaking news sent straight to your inbox.

Related Reading:

Click here to read other Medical Real Estate News

Childcare dominates new year with CBRE brokering 7 deals in 30 days

Highly rated AMIGA Montessori Centre business for sale by CBRE

Brand-new Medical Centre for lease in Victoria’s Highest Growth Municipality by CBRE

Two WA childcare centres sold to Australian Unity $13.495 m through LJ Hooker Commercial Perth